BACK TO RESEARCH WITH IMPACT: FNR HIGHLIGHTS

The financial world can be daunting and complicated with its vast array ofmonetary concepts and policies. Many banks, organisations, and financial institutions are looking to simplify their daily operations by shifting their attention toward implementing AI technology. One specific topic of interest is inflation – or, more specifically, the question of utilising AI to predict the inflation rate accurately.

Dr. Martina Fraschini, Assistant Professor of Digital Finance at the University of Luxembourg, and her team have embarked on a journey to improve the modeling and forecast of inflation, an activity critical to the economy’s financial well-being.

Martina and her team have developed an in-depth research project that aims to address two main goals: (1) improve the forecasting of inflation using Artificial Intelligence, and (2) propose more efficient steps to target inflation reduction.

The technology behind Artificial Intelligence is one of the main drivers behind the research project. The research team around Martina employs Large Language models (LLMs) to collect information from various sources, including news channels, company earning calls, investor statements, political speeches, etc.

This enormous amount of information will then be transformed into numerical data, allowing the researchers to build statistical models that can potentially generate more precise inflation forecasts.

Transforming text into numbers

“One of the most challenging aspects of our work is to transform the large amount of textual information around inflation and transform it into numerical data. This requires a lot of resources and technical know-how. ”Dr. Martina Fraschini Assistant Professor of Digital Finance at the University of Luxembourg

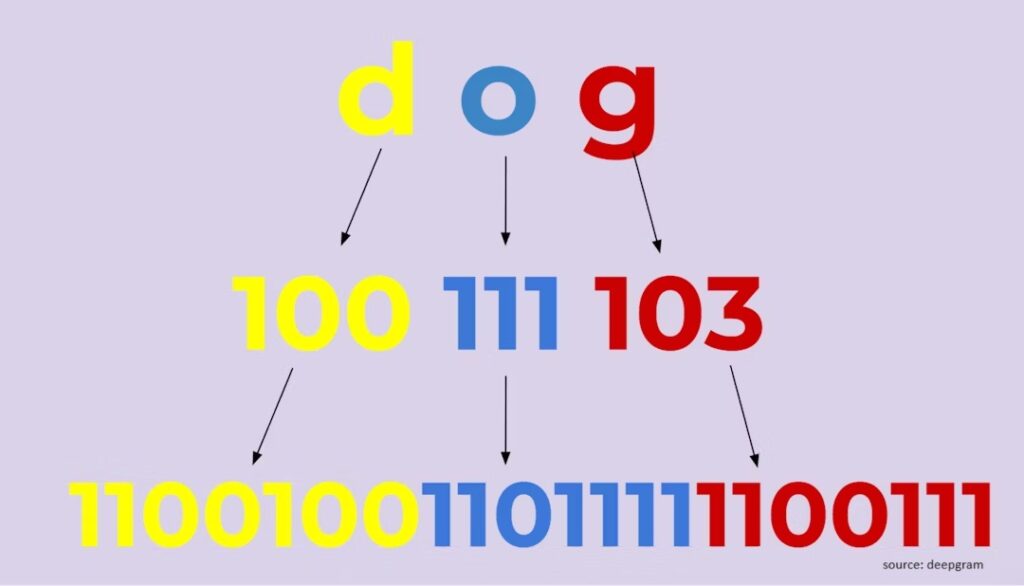

Computers do not inherently understand textual information and the relationship between grammar, words, and sentences. LLMs leverage a machine-learning technique called vectorisation, which allows them to transform text into numerical data.

Vectorisation captures the semantic complexities of words and translates them to a corresponding vector of real numbers. With their enormous computing power and storage capacity, LLMs can extract large amounts of text and transform it into sensible numerical information.

Better and more reliable models in the financial industry

Martina emphasises that financial institutions such as Central Banks, which oversee inflation regulation, are still struggling to accurately evaluate the unpredictable rates and patterns of inflation. She points out that many of the prevailing inflation models rely on research and data collection practices that may not fully capture the complex factors driving inflation today, including geopolitical events and supply chain issues.

“Modern AI technology enables us to crawl the Internet for all relevant information on inflation-related topics, which can ultimately help us create more reliable and accurate inflation models.”

AI – New testing ground for the financial sector

“I believe we can create a reliable proof of concept on how to intelligently implement Artificial intelligence in the economic sector and into financial operations.”

Martina stresses that this project aims not necessarily to replace existing inflation models but to provide empirical evidence that AI can be used effectively to extract information and generate more complete prediction models. AI implementation is still in its infancy in most private and public workplaces, including the financial sector.

Martina and her team want to improve the knowledge bases around AI applications further, add theoretical and technical understanding of AI-related processes, and provide practical applications for the financial industry, ultimately leading to more informed decision-making and better economic outcomes for both institutions and the general public.

Written by John Petit

John Petit is a communication consultant, holding a PhD in the field. His expertise lies in exploring the intersection of technology and society, with a particular focus on Artificial Intelligence (AI) and its impact on our daily lives and broader societal norms. John combines his academic knowledge with practical experience to engage in and facilitate meaningful discussions about the role AI will play in shaping our future.

Related highlights

Navigating Artificial Intelligence: Expert Discussion on Innovation, Challenges, and Europe’s Regulatory Landscape

The emergence of Artificial Intelligence has impacted our daily lives in many aspects. As the technology continues to evolve, our…

Read more

Fortifying online defenses: SVALINN’s innovative approach to combatting AI cyber threats

The emergence of Artificial Intelligence has given rise to many new applications and software programs, allowing online users to complete…

Read more

Artificial intelligence and education – The transformative power of ChatGPT

The rapid developments in Artificial intelligence have radically changed our perceptions and attitudes toward the role of technology in society…

Read more

PLAITO – Improving the ethical capabilities of software with Artificial Intelligence

Artificial intelligence has dramatically transformed our understanding of technology and influenced our interaction with online content and software applications. Whether…

Read more