BACK TO RESEARCH WITH IMPACT: FNR HIGHLIGHTS

Sustainable capital market investments are expected to reach 53 trillion USD – about 1 in every 3 dollars invested – by 2025. Meanwhile, a much lower level of funds are going directly into climate-related projects, leading to an increasing concern of greenwashing in the market. Researchers are developing science-based tools to measure the environmental impact of financial investment decisions.

The field of sustainable investing, or socially responsible investing, while far from a new concept is only now becoming mainstream.

“I was fascinated when I read a paper written in 1972 by Milton Moskowitz saying the following “There is a theory going around that the social performance of corporations can be influenced by capital markets responding to pressures from investors and customers who perceive new goals for their money”, says researcher Ioana Popescu.

Multi-disciplinary researchers have since tackled the issue, proposing tools to measure the impact of sustainable investments – such as measuring the alignment of investment portfolios with the 1.5°C global warming scenario.

“My research targets both financial market institutions as well as retail investors like us, whose future financial flows, for example pensions or insurances, depend on how the money is invested,” explains PhD researcher Ioana Popescu.

“Traditionally, markets have a short-term view on profit, whereas the climate change challenges investment actors to think long-term.”

Designing metrics with a life cycle approach & a simple methodology

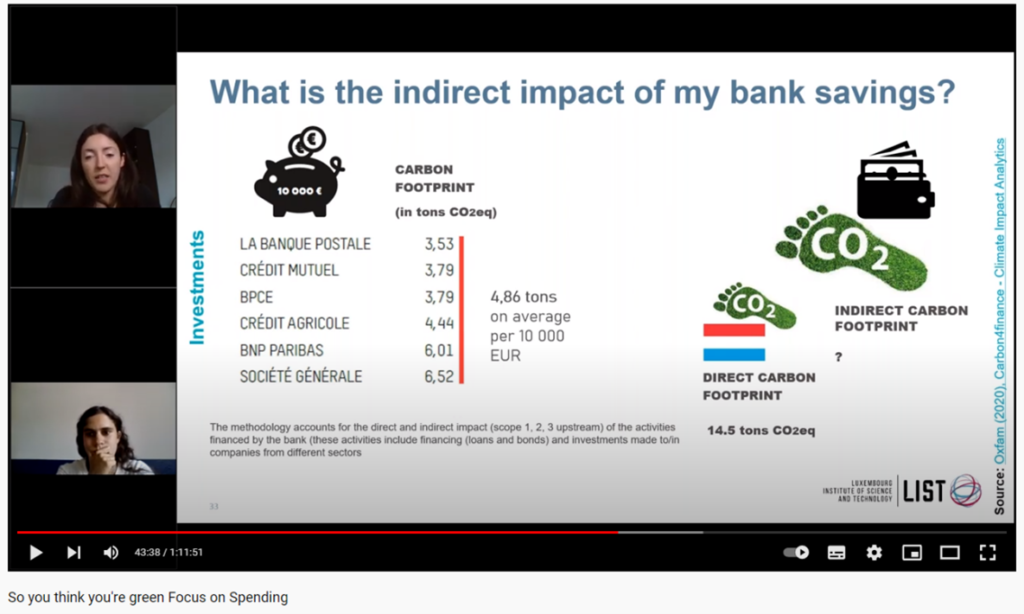

One of the key challenges facing researchers in the field is designing metrics that take a life cycle approach to impact and at the same time have a simple, easy-to-scale and homogenous methodology across different economic sectors and financial instruments.

“The greatest obstacle to overcome is having reliable and complete raw data on which to build these metrics,” Ioana explains.

“Investment funds own companies across different sectors and geographies. On their end, companies depend on thousands of suppliers and their products cause environmental impacts that are hard to trace. The question is thus how to best use available data and estimation methods to overcome this hurdle.”

Findings from a case study conducted by Ioana, using the input-output life cycle assessment preliminary methodology to measure the relative carbon footprint of sustainable investment funds, compared to conventional funds, presented at conferences in 2021.

Climate change impact of over 90% of companies listed at the stock exchange has been estimated

Ioana Popescu’s research aims to bridge best-practice sustainability assessment tools from the industrial ecology field with information on financial investments. The goal: to achieve homogenous estimates to guide asset managers and end investors alike.

“While in the industrial ecology field one rather looks at the impact of a single product or system, in finance we take a more global approach and consider an investment fund as a combination of different economic activities.”

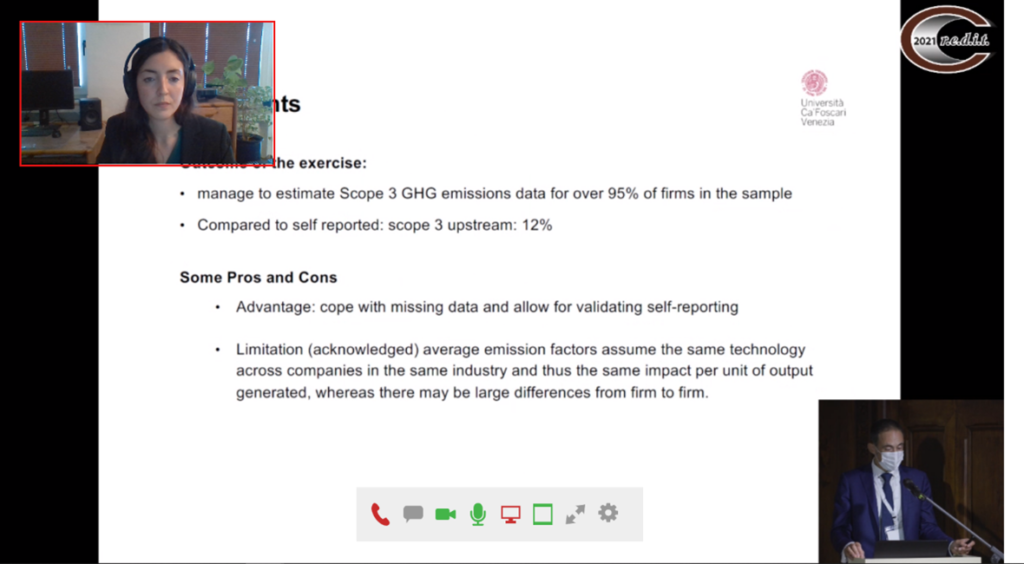

Ioana uses input-output analysis as a methodology to derive regionalised industry-level environmental impacts, which is then combined at the level of a company to derive an estimate of its environmental impact. In a final step, the impact is further aggregated at the fund level.

“With my model, I managed to estimate the climate change impact of over 90% of the companies listed at the stock exchange, much higher than current reported data and comparable to data provided by private companies for large fees. I would not call it new knowledge, but simply an important statement that I hope will encourage the industry and literature to not hide behind the ‘lack of data’ issue and move towards acting, based on the best-available estimates,” Ioana concludes.

Ioana Popescu is a Finance and Business Graduate and a 3rd year PhD candidate in the SUSTAIN group of the Environmental Research and Innovation (ERIN) department at the Luxembourg Institute of Science and Technology (LIST), working on a project funded in the framework of the FNR’s OPEN programme (supervisor: Enrico Benetto).

MORE ABOUT IOANA POPESCU

On what drives her as a scientist

“I am driven by the belief that finance has the role to allocate funds efficiently for the environment and the society at large. Coming from the finance world, I was inspired by the dedication and knowledge of my colleagues from the life cycle sustainability assessment field, and I realized how much finance is missing by not listening to the real science.”

On the appeal of research

“I like research because I am working on questions where there is no correct answer. This makes the working process quite exciting, unlike in a normal corporate job, when you know from the beginning where you need to arrive. In research, you start with a goal in mind, but you will see on the way where the journey takes you.”

On where she sees herself in 5 years

“In 5 years, I will still be doing something at the intersection of sustainability – finance – people, but I could not say where, could be in an NGO, in a policy institute, in an impact investing company or in academia. It is amazing that I have so many options for the future due to having a PhD project that is relevant in both private and public sector.”

On her ‘tribe of mentors’

“I am so lucky that my project team is also my “Tribe of Mentors”. Claudia always cheers me up, has my side and inspires me to become a better woman in research. Thomas is my example of passion and makes me see all research challenges as fun quests to solve. Claudio convinced me to first join LIST as an intern and is still always there to give me advice right when I need it. Mirco helps me navigate the complexity of asset pricing and teaches me how to approach the finance part of my research. Finally, Enrico challenges me to do more than I think I can and inspires me in terms of leadership and research work ethic.”

On choosing Luxembourg as a research destination

“Luxembourg has a buzzling sustainable finance ecosystem. When I finished my Master’s, I knew I really wanted to work in sustainable finance, but I never thought I would want to do a PhD…until I found a research internship on the topic at LIST. From the first interview with my colleagues, I felt welcomed and that I would fit the work environment, which determined me to start here and continue with the PhD. Besides having a great international research environment, the conditions of being a PhD student are very good here. Furthermore, one is very well connected to the industry and to other researchers, due to the small size and concentration of research activities.”

On participating in Chercheurs à l’école, where researchers ‘go back to school’

“I think it is really great that such initiatives exist in Luxembourg. Bringing researchers and high-school students in a conversation together is beneficial for both sides. For me, it was a great opportunity to travel back in time to my high school years and to think about what questions students may have about career and research now. It was also a fun challenge to try to communicate my research in a way that they would understand and be intrigued. For example, I talked to the students about the implications of considering environmental impacts in their investment decision. It was fun to see that they do have a strong business sense – they told me that they would invest in a less profitable company if it pollutes less, but only if the difference in return is not too high when compared to other more profitable, but also more polluting companies.”

All photos by Ioana Popescu

About Spotlight on Young Researchers

Spotlight on Young Researchers is an annual FNR campaign where we shine a Spotlight on early-career researchers across the world with a connection to Luxembourg. Nearly 100 features have been published since the first edition in 2016.

Browse them below!

RELATED FUNDING